Overview: Taproot is Bitcoin’s major protocol upgrade, activated in November 2021 (block 709,632). It bundled three Bitcoin Improvement Proposals (BIPs 340, 341, 342) to introduce Schnorr signatures, a new Pay-to-Taproot (P2TR) output format with MAST (Merklized Abstract Syntax Tree), and an upgraded script engine (Tapscript). In practice, Taproot allows complex transactions (multi-signature wallets, smart contracts) to appear on-chain like ordinary payments. This means a Lightning channel, for example, will look like any other spend. As one analyst noted, the upgrade "solidifies Bitcoin... offering improved support for smart contracts and DeFi applications", while another called it “one of the most significant upgrades” to Bitcoin, aimed at enhancing privacy, scalability, and flexibility.

Taproot was implemented as a soft fork (backward-compatible change) when 90% of miners signaled support in mid-2021. Because it was a soft fork, no new coin was created – all nodes share the same blockchain history, and old-address transactions remain valid. Taproot had near-unanimous support among developers and miners (unlike earlier contentious upgrades). In sum, Taproot is Bitcoin’s first major upgrade in over four years (since SegWit), and it lays a foundation for future innovations on the network.

Why Taproot Matters

Taproot’s importance comes from its user-facing benefits. First, it increases privacy and fungibility: all Taproot outputs (bc1p… addresses) share the same format, making different transaction types look alike. In effect, a pay-to-multi-sig or a complex script cannot be distinguished from a simple single-signature spend on-chain. As Blockstream explains, multisig Taproot transactions are “indiscernible from single-sig ones,” which helps hide spending details. Similarly, a Taproot output can hide unused script branches (thanks to MAST), so observers only see the executed branch, vastly improving confidentiality. Overall, Taproot “preserves privacy of Bitcoin holders” by making transactions cheaper to verify and indistinguishable in type.

Second, Taproot reduces fees and boosts throughput. By switching to Schnorr signatures and aggregating keys, Taproot transactions pack data more tightly. One estimate says Schnorr can shrink transaction data by roughly 30% compared to the old ECDSA scheme. In particular, multi-signature spends see the biggest gains: e.g., a 2-of-2 or 3-of-3 wallet only adds one extra aggregated signature instead of separate ones for each signer. This smaller data means lower fees per transaction and more TXs per block on average. As the OSL blockchain blog notes, Taproot “reduces the amount of data stored on the blockchain… resulting in lower transaction fees and faster processing times”. For end-users, this can mean cheaper complex transactions (like channel opens or multisig spending) and smoother confirmations.

Third, Taproot unlocks richer scripts and smart contracts. The new Tapscript language and MAST allow developers to write more sophisticated on-chain conditions while revealing only the needed logic. For example, time-locked contracts, inheritance vaults, or multi-stage agreements can be implemented without bloating the blockchain – unused conditions remain private and out of the chain data. In essence, Taproot acts like a smart-contract plumbing upgrade: it doesn’t turn Bitcoin into Ethereum, but it makes advanced features (conditioned payments, DeFi primitives) much more practical on Bitcoin. Future innovations (like asset issuance or DeFi) can build on Taproot’s capabilities.

Overall, Taproot “sets the stage for future innovations” on Bitcoin. It was explicitly designed to be “the last big upgrade” of its kind before more layered applications take off. While many users won’t notice any immediate change, Taproot quietly improves Bitcoin’s efficiency, privacy, and functionality in the background.

How Taproot Works – Cryptography & Protocol Changes

Schnorr Signatures (BIP340). Taproot replaces Bitcoin’s original ECDSA signatures with Schnorr signatures. Schnorr signatures are simpler and smaller (32-byte public keys, 64-byte signatures, vs ~33-byte keys and ~71-byte signatures for ECDSA), making every signature more compact. Crucially, Schnorr supports signature aggregation: multiple parties’ keys and signatures can be mathematically combined into one. As Lightspark explains, this lets “multiple parties sign a transaction without revealing each signature”. For example, a 2-of-2 multisig spend can be merged into one combined signature verifiable by anyone. This both saves space and obscures the fact that multiple keys were involved. In short, switching to Schnorr makes signatures faster to compute and verify, smaller in size, and much more flexible. (It also adds slight energy saving by enabling batch validation of sigs.)

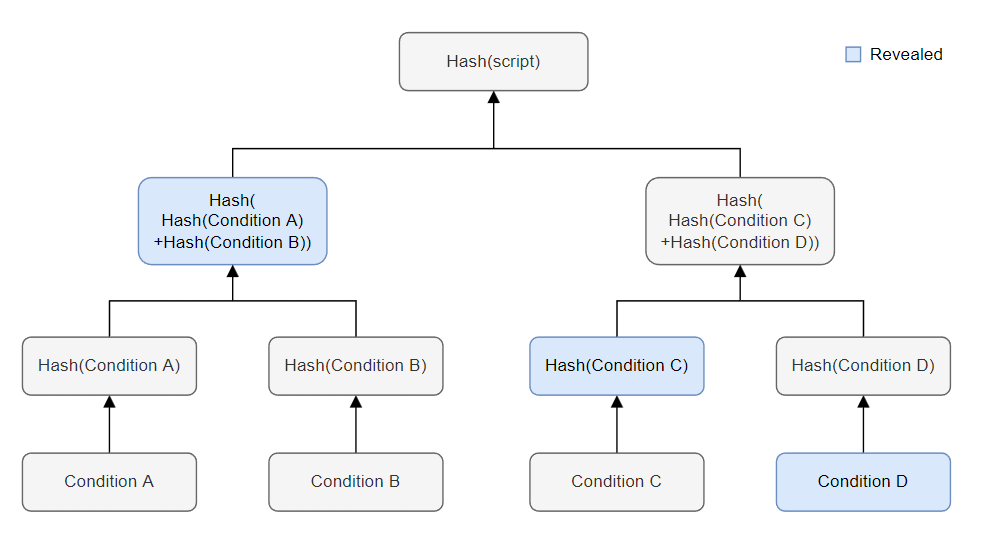

Taproot Outputs and MAST (BIP341). Pay-to-Taproot outputs are a new script template (witness version 1) that combines a public key with a Merkle-tree commitment of script branches. In practice, each Taproot UTXO includes one public key. Spending it can follow two paths: a key-path spend where just a signature to that key is presented, or a script-path spend where a script and proof of its inclusion in the tree are given. The tree (MAST) is built from all possible spending scripts (conditions) for that output, but only the executed branch is revealed. All other branches stay hidden within a single Merkle root hash. The result is that a complex transaction (many possible conditions) is compressed into one public key + a single revealed branch.

MAST has two main effects: it hides unused script logic and it shrinks data. An observer cannot see any scripts that weren’t used, only the condition executed. BitBox’s guide notes that with Taproot, even lightning-channel or multisig transactions “look like any other Taproot transaction” to outside observers. Chainalysis also explains that MAST allows complex scripts to be “compressed… into a single hash,” reducing fees and memory use. In other words, Taproot transactions with hidden fallback paths appear identical to simple pays-to-key, greatly enhancing fungibility.

Tapscript & OP_SUCCESS (BIP342). Tapscript is a

minor overhaul of Bitcoin’s scripting engine to support Taproot. It updates

signature checking to work with Schnorr and adds new flexibility for future

changes. Notably, BIP342 introduced OP_SUCCESSx opcodes – null, no-op instructions that always succeed. These are

placeholders that let developers add new script features in later soft-forks

without breaking existing scripts. In sum, Taproot’s script version (v1)

allows for new opcodes and more complex scripts while still preserving older

rules. Old script types (P2WPKH, P2SH, etc.) remain valid, so wallets can mix

legacy and Taproot outputs freely.

Soft-Fork Activation. The three BIPs (340, 341, 342) were activated together as a soft fork. This means Bitcoin nodes had to upgrade software, but those that didn’t will still accept Taproot transactions as valid (just without understanding the new features). No new chain was created – Bitcoin Cash (2017) style splits did not happen with Taproot. The activation was smoothly done once miner support was locked in by June 2021. After the switch, Taproot transactions could start appearing on-chain. Eventually, wallets and miners updated, and Taproot-capable software (Bitcoin Core, wallet libraries, explorers) began handling the new signatures and addresses.

User-Facing Impacts

Privacy. Taproot substantially boosts on-chain privacy. By design, every Taproot transaction (spent via the key-path) looks like a simple spend-to-key. Multi-signature spends, Lightning channel closes, and complex smart-contract spends all use the same transaction structure and size. Blockstream emphasizes that a multi-sig Taproot spend is indistinguishable from a normal spend. Law-enforcement guides likewise note that Taproot addresses “make all Bitcoin transactions look similar,” enhancing privacy. In practice, this means blockchain analysts cannot tell how many participants or conditions were involved, only the final payment. Combined with MAST, only the one executed contract condition is revealed – unused conditions never appear on the blockchain. This hides advanced spending logic and cuts out data that would have been public without Taproot. Overall, Taproot takes hidden contracts and makes them truly opaque: if a wallet uses only the basic key-path, its transactions simply blend in with everyone else.

Scalability and Fees. Taproot improves efficiency under the hood. Thanks to signature aggregation, many transactions become smaller. For example, Lightspark notes Schnorr sigs are ~30% smaller than ECDSA sigs. More importantly, a 3-of-3 multisig Taproot spend might now be almost the same size as a 1-of-1 spend, because all three signatures collapse into one. This frees up block space: nodes can include more transactions in the same 1 MB (1 WBU) block, improving throughput. Lower fees are a natural outcome: OSL’s guide observes that Taproot’s smaller transactions “result in lower fees”. Users with complex use cases (multisig vaults, channel opens, batch payments) see the biggest savings.

However, there is a nuance: for a single-sig payment to a Taproot address, the data can be slightly larger than to a SegWit address. In fact, BitBox points out that a Taproot output is technically heavier, so “sending to a Taproot address is more expensive” than SegWit, even if spending it is cheaper. In practical terms, this means that casual users sending from old wallets to a Taproot address may pay a tiny premium. But if spending from that Taproot UTXO (i.e., including it as an input), the aggregated signature makes up for that. In other words, Taproot shines when the enhanced features are used; on very simple transactions, the benefit is modest. Still, as more users switch over, the overall network gets faster and cheaper, akin to the way SegWit eventually lowered fees network-wide.

Smart Contracts & Features. Every day, users gain richer scripting without complexity. Because Taproot hides script details, wallet developers can implement more advanced features without confusing the blockchain. For example, a wallet could offer a vault that requires a backup key to recover funds; under Taproot, this vault script would not bloat the blockchain unless the backup is used. Time-locks and multi-stage withdrawals can similarly be hidden by default. This was simply impractical before Taproot: Bitcoin had smart-contract support only in a very limited way (bare multisig and timelocks), and every contract call was fully visible. Now, even savvy “Bitcoin-DeFi” ideas (crowdsales, trustless exchanges, etc.) are more feasible because the scripts won’t stand out. Additionally, Lightning Network developers have proposed Taproot-based features (like PTLCs – Point Time-Locked Contracts) to make off-chain payments more private.

Lightning Network. Taproot has direct benefits for Lightning. Lightning channels are funded by 2-of-2 multisig transactions, which were previously easier to identify and heavier. With Taproot, the key aggregation makes funding transactions much cheaper and chain-indistinguishable from normal payments. Voltage’s analysis notes that Taproot makes channel openings both cheaper and more private: “aggregating signatures means… lighter transactions and therefore cheaper channel openings,” and the aggregated signature makes a channel open look like a single-sig spend. In practice, this reduces fees for on-chain channel operations and conceals Lightning usage patterns. (Full privacy of publicly announced channels also depends on Lightning protocol changes, but private channels automatically get this benefit.) Overall, Taproot was a key enabler for next-gen Lightning features and fee savings.

Wallets and Addresses. Taproot introduced a new address format: bech32m addresses starting with “bc1p”. These are native witness v1 (P2TR) outputs. To use them, wallets needed updates. Most modern Bitcoin wallets now support sending to Taproot addresses; for example, Coinbase added Taproot support in late 2024. However, not all services were updated immediately. As Blockstream warns, to receive on Taproot, you must use a Taproot-compatible wallet (the receiver must create a bc1p address). Legacy (1…) and SegWit (bc1q…) addresses still work as always – Taproot did not remove them. Users can hold funds in any address type interchangeably. In short, everyday users do not have to do anything special to keep using Bitcoin. If you want Taproot’s perks, generate a new bc1p address with an updated wallet. If not, your old workflows continue unchanged.

Miners. Miners benefited from Taproot through extra revenue potential. New transaction types (like Ordinals) and smaller tx sizes can increase throughput and fees in blocks. Miners also needed to run updated node software to validate Taproot. In practice, since 90% had signaled readiness, most mining pools and software (eg, recent Bitcoin Core) were already ready for activation. No hardware changes were needed – Taproot was just a code update.

Exchanges and Services. Exchanges and custodial services had to add Taproot support for deposits/withdrawals. By 2024, many big names will do: Coinbase, OKX, Kraken, Bitfinex, BitMEX, and Blockchain.com all support Taproot transactions. Others like Binance, Crypto.com, and Gemini were late to add it as of late 2024. The practical implication: early on, some services did not allow sending funds to a BC1P address (it would fail). Users had to wait or use a different wallet. That is now mostly resolved. As adoption continues, Taproot support in wallets and exchanges will become ubiquitous.

Current Usage and Developments (2021–2025). In the first years after activation, Taproot’s adoption was modest. Only a tiny fraction of Bitcoin was sent to P2TR outputs – Coin Metrics reported about 0.06% of all BTC in Taproot outputs by mid-2022. Chainalysis and others expected this: SegWit had a multi-year rollout (50% usage in 2 years, ~80% in 4 years), and Taproot followed a similar slow curve.

A major twist came in early 2023 with the Ordinals NFT craze. Bitcoin developers found that Taproot made it easy to inscribe data (images, text) on-chain as “non-fungible tokens”. This drove Taproot transaction share from under 2% up to about 9–10% by February 2023. Another token standard, BRC-20 (a Bitcoin-native fungible token inspired by Ethereum’s ERC-20), also relies on Taproot data encodings. These new uses boosted miner fees (good for miners) but sparked debate: some Bitcoiners cheered the innovation, while others worried about network congestion and “gambling” uses. The River (River.com) article notes that while such inscriptions give miners extra fee income, they also “increase the cost for users to use the blockchain” and move Bitcoin beyond pure payment purposes. In short, Taproot unwittingly became the enabler for NFTs on Bitcoin, a feature with mixed reception.

By mid-2023, the Ordinals hype had settled down, and Taproot transaction percentage dipped back into the low single digits. Ongoing usage trends into 2024 show Taproot now used for a few percent of blocks on average. Adoption among software continued: Bitcoin Core, Electrum, hardware wallets (Ledger, Trezor,) and mobile wallets gradually rolled out full Taproot support. Exchanges updated their infrastructure too: as noted, Coinbase added support in Oct 2024, and others followed suit.

Looking forward, Taproot remains a foundation rather than the finish line. It enables upcoming protocols like Taro/Taproot Assets: Lightning Labs announced in 2022 a Taproot-powered protocol called Taro for issuing tokens (e.g., stablecoins) on Bitcoin. More proposals (OP_CAT, OP_CTV, covenant scripts) are being discussed and could build on Taproot’s infrastructure. But for now, Taproot is largely stable and quietly used.

Taproot vs SegWit: What’s Different?

Taproot and SegWit are both soft-fork upgrades, but they serve different goals. SegWit (activated in 2017) was aimed at fixing transaction malleability and improving block efficiency by separating witness data. Taproot (2021) builds on that by changing the signature and scripting system. Key differences:

- Signature scheme: SegWit still uses ECDSA; Taproot switches to Schnorr (BIP340). Schnorr signatures are smaller and allow key aggregation, which ECDSA does not.

- Transaction size: Both reduce data weight, but SegWit mainly moved signature data to a different part of the block. Taproot further reduces size for multi-sig and script spends via aggregation. A simple SegWit transaction is already lighter than legacy, but Taproot makes complex spends even lighter.

- Privacy: SegWit alone did not hide the existence of multi-sig or script complexity. With Taproot, multi-sig transactions look just like single-sig ones. (SegWit added witness data but still showed script hash patterns.)

- Scripts: SegWit did not add new scripting capabilities, only changed how data was structured. Taproot introduces Tapscript and MAST, letting nodes handle more flexible smart contracts with minimal data.

- Addresses: Native SegWit (bech32) addresses start with “bc1q…”, while Taproot addresses start with “bc1p…” using the new bech32m format. Sending to either is easy but requires wallet support.

- Compatibility: Both are backward-compatible soft forks. Old nodes accept Taproot transactions as valid (they simply consider them anyone-can-spend outputs). Taproot transactions do not split the chain.

In summary, SegWit optimized the old transaction format; Taproot rewrote the signature and script rules. They complement each other: SegWit laid the groundwork for second-layer (Lightning) by fixing malleability, and Taproot builds on SegWit’s framework to add privacy and new features. Together, they make Bitcoin more scalable and capable than the original design.

Adoption and Trends (2021–2025)

After Taproot’s 2021 activation, real-world uptake was gradual (as with SegWit). A 2022 Chainalysis report noted that it could take years to reach high adoption – SegWit took ~4 years to hit 80% usage. True to form, early statistics showed Taproot use was very low. For example, Coin Metrics reported just ~11,740 BTC (≈0.06% of supply) in Taproot outputs by mid-2022. That report noted “the adoption rate… has been slow to start,” but expected growth over time.

That growth did spike temporarily. In January–February 2023, Taproot saw a surge thanks to Bitcoin NFTs (Ordinals) and new token protocols. Data from Dune Analytics and NewsBTC showed Taproot transaction share jumped from under 2% to a peak of ~9.75% on Feb 10, 2023 (a 1,000% rise). A BanklessTimes report also noted a January 17, 2023, peak of about 4.13% Taproot use (with 1.55% actual utilization) before falling back. In other words, novel use-cases temporarily drove Taproot volume. By mid-2023, the hype cooled and Taproot usage settled back to a few percent of activity.

As of 2024–25, adoption is slowly rising. More wallets and services now support it, and new use-cases continue emerging. Lightning Labs’ Taro project is a notable example: it’s a Taproot-based protocol (alpha released in 2022) for issuing tokens and stablecoins on Bitcoin. Exchanges have been increasingly adding Taproot. Coinbase announced in Oct 2024 that retail users could finally send Bitcoin to Taproot (bc1p) addresses, fixing issues that previously caused such payments to fail. Coinbase joined OKX, Kraken, Bitfinex, BitMEX, and Blockchain.com in supporting Taproot withdrawals, though at that time, Binance, Crypto.com, and Gemini had not yet. As Coinbase noted, Taproot “supports innovations like Bitcoin-native tokens, including BRC-20” and lays the groundwork for Ordinals and upcoming protocols like Runes.

In short, Taproot is now fully live and steadily gaining ground. Its usage is no longer zero, and each year sees more infrastructure support and experimentation. While it hasn’t caused any chain splits or crises, it has enabled an active ecosystem of new Bitcoin features (NFTs, tokens, advanced Lightning) that continue to unfold into 2025.

Implications for Stakeholders

-

Developers: Taproot gives developers new building blocks. Wallet, node, and library developers needed to implement BIP340/341/342. Most major Bitcoin libraries (Bitcoin Core, BitcoinJS, etc.) have updated to handle Schnorr sigs and bc1p addresses. Protocol developers can now code more advanced smart contracts in Bitcoin (using MAST and Tapscript). On Lightning and layer-2, Taproot enables new protocols like PTLCs and Taro tokens. However, developers also had to be careful: for example, Bitcoin libraries had to manage the changed signature and script formats properly to avoid bugs.

-

Miners: Miners needed to upgrade their software (e.g., Bitcoin Core) to validate Taproot blocks. Once they did, the change was seamless. Mining itself was not materially affected – Taproot is consensus rules only. In fact, miners benefit from Taproot’s side effects: the surge of Ordinal inscriptions in 2023, for instance, led to higher fees (good for miners) and showcased Taproot’s capabilities. Miners also had to treat Taproot as a soft fork: they enforced the new rules (refusing non-compliant txs), but the chain stayed unified.

-

Wallets: Wallet software had to learn Taproot addresses. Users of major wallets (Bitcoin Core, Electrum, Wasabi, etc.) eventually could generate bc1p addresses and sign Taproot spends. Early on, only a few wallets fully supported Taproot sends. Users who didn’t upgrade could still receive Bitcoin to old addresses and spend normally; nothing was lost. But to send from a Taproot address or use new features, the wallet needed an upgrade. (For example, a hardware wallet must implement Schnorr signing in its firmware.) Today, most popular wallets support Taproot, though wallet user interfaces will now often show two address types (bc1q for SegWit, bc1p for Taproot).

-

Exchanges/Custodians: Exchanges needed to update address validation. Early in 2022, many exchanges did not allow sending to a bc1p address (because their systems saw it as invalid). This caused transactions to “get stuck” on-chain for some users. By late 2024, almost all major exchanges had enabled Taproot withdrawals. Coinbase’s Oct 2024 announcement was a milestone, explicitly adding support for Taproot withdrawals. Kraken and Bitfinex enabled it earlier. The laggards (Binance, Crypto.com, Gemini) eventually added support in 2024–2025. Now, deposit and withdrawal of Taproot BTC is generally available across platforms, but users should still check that their chosen service supports bc1p addresses. Failing to do so could mean funds are returned or lost.

-

Everyday Users: For most people, Taproot is behind the scenes. Your Bitcoin still works the same way. If you have an existing wallet, you don’t have to migrate funds or anything. In practice, using Taproot means generating new bc1p addresses (instead of or in addition to SegWit bc1q). Doing so requires an updated wallet or exchange. The benefits to a casual user might be small: perhaps a slightly lower fee if sending a complex transaction, or a bit more privacy if doing a multi-sig. But if you run a node or wallet, Taproot ensures the network can evolve. The main thing an everyday user should do is upgrade the wallet software eventually, so they can safely receive and spend Taproot coins. Otherwise, Bitcoin works as normal – Taproot only adds optional improvements.

Frequently Asked Questions about Taproot

-

What is Taproot? Taproot is a Bitcoin protocol upgrade (implemented via soft fork in Nov 2021) that added Schnorr signatures and a new scripting format (Taproot/MAST). It lets complex scripts and multi-signature spends be hidden behind a single public key, improving privacy and efficiency.

-

When was Taproot activated? The upgrade locked in with overwhelming miner support in mid-2021 and became active at block 709,632 on November 14, 2021.

-

Do I have to do anything as a user? No urgent action is needed. Bitcoin stayed backward-compatible: all your old funds and addresses still work. If you want to use Taproot, you will need a wallet that can create and spend Taproot (bc1p) addresses. Otherwise, nothing changes.

-

How does Taproot differ from SegWit? SegWit (2017) introduced Segregated Witness to fix malleability and reduce block weight; Taproot (2021) introduced Schnorr signatures and script tweaks. Both reduce data size, but SegWit mainly reorganizes where data is stored, while Taproot changes the signature scheme and hides script details. Think of SegWit as optimizing the existing format and Taproot as a deeper redesign for privacy.

-

What is a Taproot (bc1p) address? It’s a Bitcoin address type introduced by Taproot. It starts with

bc1p...(using the bech32m format). Sending to a Taproot address uses the new output type (witness v1). To use one, you need a wallet/exchange that supports generating and sending to bc1p addresses. -

Will my fees be lower with Taproot? Possibly. If you perform multi-signature or otherwise complex transactions, Taproot can significantly reduce fees by compressing signatures. However, if you only do simple single-sig payments, the difference is small (and sometimes sending to a Taproot address can cost a bit more than to a SegWit address). In general, heavy users (miniscript, LN, batching) see the most fee savings; everyday P2PKH/P2WPKH users see only minor changes.

-

Is Taproot a hard fork, or do I need new coins? No. Taproot was a soft fork. You do not get new coins, and your BTC did not split. No chain was created (unlike Bitcoin Cash in 2017). All coins on old addresses remain valid and become usable in Taproot once the upgrade is activated.

-

How does Taproot improve privacy? By hiding the transaction structure. Before Taproot, anyone could see a transaction’s details (e.g. it was a 2-of-3 multisig, or a Lightning channel). Now, thanks to signature aggregation, that same transaction simply looks like an ordinary payment. Taproot also hides unneeded scripts (MAST). Observers see only a single public key and a signature, not the inner workings. This makes blockchain analysis much harder.

-

What is MAST? MAST stands for Merkelized Abstract Syntax Tree. It’s Taproot’s method of committing to many possible spending conditions in one tree. When spending, only the branch you use is revealed. All other potential conditions stay hidden (only a hash of them is on-chain). This keeps unused script logic private and reduces data.

-

Are all Bitcoin transactions Taproot now? No, Taproot transactions are still optional. Only wallets that choose to use Schnorr and Taproot addresses will create P2TR outputs. Many transactions remain legacy or SegWit. Over time, adoption is increasing, but not every transaction on Bitcoin is Taproot.

-

I’ve heard about Ordinals and NFTs on Bitcoin. Are they related to Taproot? Yes. Ordinals inscribe data onto satoshis (tiny Bitcoin units) using Taproot outputs. Taproot made this easier by allowing larger witness sizes. While it was already possible to add data before, Taproot’s activation enabled new protocols (BRC-20 tokens, inscriptions) that soared in early 2023. It’s a controversial use – some view it as innovative, others as spam – but it’s powered by Taproot.

-

What do developers do with Taproot now? They are building. Ideas include issuing assets on Bitcoin (e.g. stablecoins) via Taproot-based schemes, more efficient contract protocols, and future upgrades. Lightning Labs’ Taro project (2022) uses Taproot to issue tokens on-chain. Other proposals (covenant scripts, OP_CAT, etc.) depend on Taproot’s framework. We’re likely to see many more layers and features built on these capabilities in the coming years.

-

Where can I learn more? You can read the official BIPs (340, 341, 342) or many educational articles (Chainalysis, Bitcoin Magazine, etc.) about Taproot. The key takeaway: Taproot quietly makes Bitcoin better – more private, more efficient, and ready for new types of applications – all while keeping Bitcoin familiar and secure for users.

Sources: Authoritative guides and analyses of Bitcoin’s Taproot upgrade, including Chainalysis, Lightning Labs, Blockstream, and OSL’s blockchain research team.